gst claimable expenses malaysia

A GST registered retailer can claim GST incurred on its trading stocks which are taxable supplies such as biscuits chocolates soft drinks instant noodles and nuggets. Lam Kok Shang and Gan Hwee Leng of KPMG preview the introduction of goods and services tax GST in Malaysia from April 1 2015 comparing it with the equivalent regime.

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

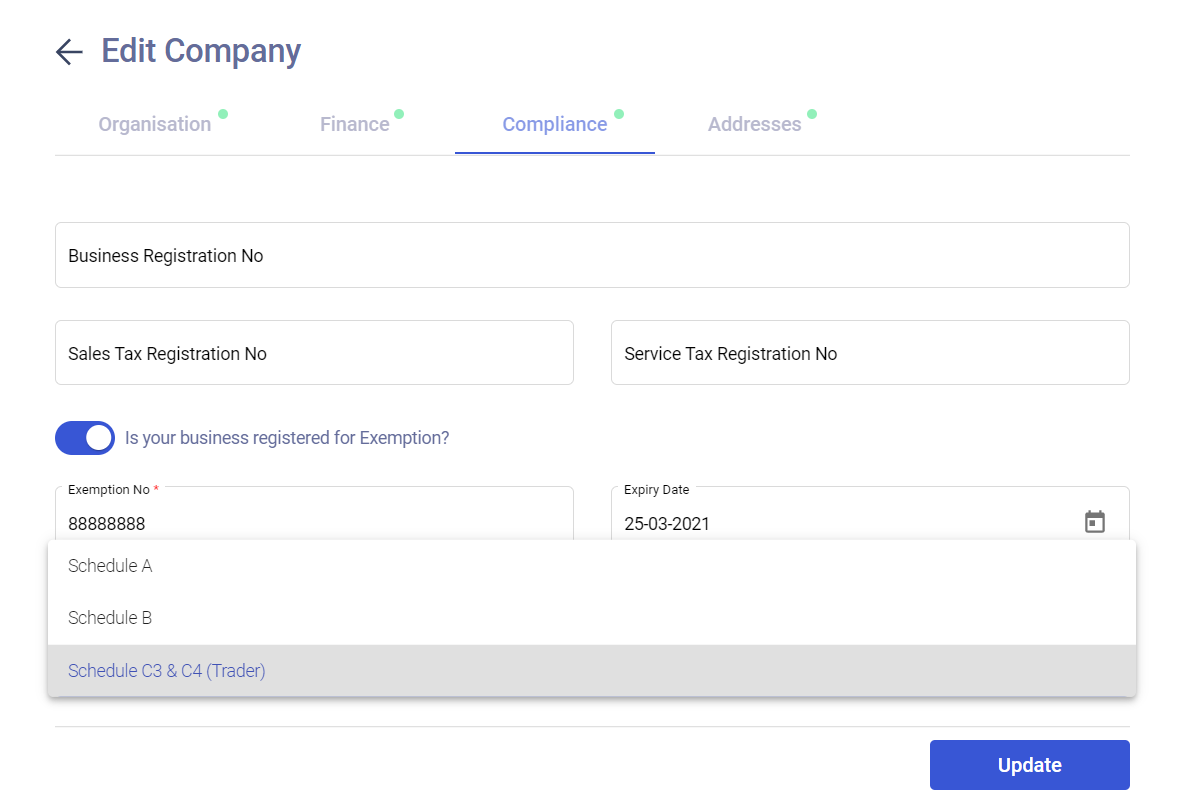

Approved Trader Scheme ATMS Scheme.

. Both must be resident and incorporated in Malaysia. You can claim input tax incurred on your purchases only if all the following conditions are met. 512 GST is also charged and levied on all.

GST in Malaysia will be implemented. The input tax credit mechanism ensures that GST is chargeable only on the value added by a business. Small value assets with values not exceeding RM 2000 are eligible for 100 capital allowance.

TaXavvy Issue 7-2017 2 Public rulings on income tax treatment of Goods and Services Tax The Inland Revenue Board IRB has recently issued Public Ruling 12017 Income Tax Treatment. Overview of Goods and Services Tax GST in Malaysia. Each has paid-up capital of ordinary shares exceeding MYR 25 million at the beginning of the basis period.

NON ALLOWABLE INPUT TAX While is general input tax is claimable under Standard and Zero-rated supplies there are certain instances where Input Taxes are blocked ie. For more information regarding the change and guide. TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy.

Without ITC GST would be charged on gross sales by every business throughout the. In Singapore and Malaysia BL GST code is an example of a non-claimable GST. Imports under special scheme with no GST incurred eg.

GST on import of goods. Given only to the Sole Proprietor Partners or Directors of the company. INLAND REVENUE BOARD OF MALAYSIA.

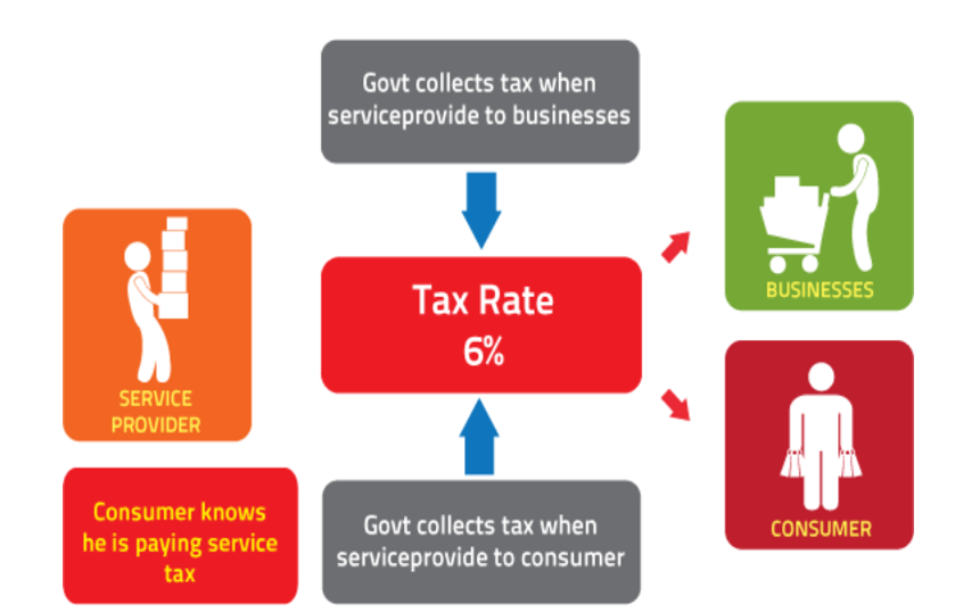

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Approved Trader Scheme ATMS Scheme. In Malaysia there are criteria that a business need to meet in order to be eligible to claim the GST input tax credit for employee expenses reimbursement.

However the total capital allowance of all small-value items is capped at. The criteria are as. Claim input tax Value Added Activity Added Value.

Purchases with GST incurred but not. Imports under special scheme with no GST incurred eg. GST on import of goods.

Deloitte Malaysia experts propose tax shelters incentives to get Malaysians back on their feet. Expenses Existing contracts - should the supplier. Shall it be subject to gift rule and other.

GST treatment for condolence expense is another tricky area on whether claimable or non claimable expense for input tax credit. The GST incurred on. The goods or services are.

Purchases with GST incurred but not claimable Disallowance of Input Tax eg. Speaker Profile Thenesh Kannaa CAM FCCA. A medical expense of 10000 incurred with a GST of 600 Based on the.

Jabatan Kastam Diraja Malaysia Appendix 2 -. Medical expenses for staff. A imported goods except.

For Budget 2022 the government is expected to allocate a total sum of RM3483. GST input tax claimable. A non-claimable item listed under Regulations 26 and 27 of the GST General Regulations.

HISTORY OF GST IN MALAYSIA. Knowledge of the fundamental aspects of GST. Purchases with GST incurred.

PART I EXPENSES PUBLIC RULING NO. Conditions for claiming input tax. SBL claimable subject to approval.

Around The World In 46 Carbon Markets Paris Climate Climates Climate Action

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Professional Tax Invoice Template Example Invoice Template Nz For Tax Invoicing Purpose When You Are Making Your Invoice Template Templates Invoice Example

Sales And Service Tax 2018 Sst In Malaysia Tax Taxact Bad Debt

Guide To Gst For Healthcare Services Malaysia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Malaysia Sst Sales And Service Tax A Complete Guide

Chapter 6 Business Income Students 1

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018 Ringgitplus Com

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

No comments for "gst claimable expenses malaysia"

Post a Comment